Nvidia shares

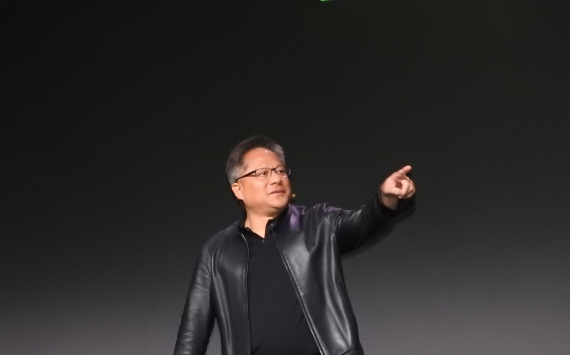

NVIDIA held a conference call on Monday announcing its Grace server chip, BlueField-3 DPU, new NVIDIA RTX graphics chips and other new products, and raised its financial outlook for the current quarter. Intel shares were down 4.2%.

NVIDIA (NVDA) shares gained 5.6 percent on Monday, approaching the highs reached in February.

On April 12, NVIDIA demonstrated another leap in technology. Investor enthusiasm was driven by a number of positive announcements about new products, technologies and partnerships made by the company during an online conference call.

NVIDIA has long focused primarily on graphics processors rather than CPUs, but its recent success suggests that the company is determined to take a significant share of the market, which is dominated by Intel (INTC).

On Monday, NVIDIA unveiled its high-performance Grace processor, which is based on Arm architecture and designed to solve artificial intelligence problems in data centres.

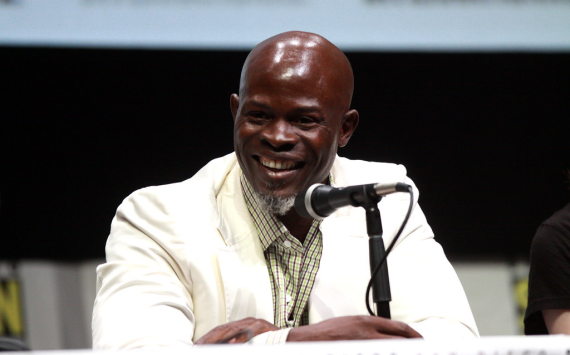

NVIDIA CEO Jensen Huang announced that the Swiss National Supercomputer Center will build an Alps supercomputer based on Grace and NVIDIA's next-generation GPU. The US Department of Energy's National Laboratory in Los Alamos will also unveil a Grace-based supercomputer in 2023.

NVIDIA data centre products are now the company's fastest growing segment, with revenue for the fiscal year ended Jan. 31, 2020 growing 124 percent to $6.7 billion, while its core graphics chip business grew a relatively modest 41 percent to $7.76 billion.

Amid a stronger competitive threat from Nvidia, Intel shares fell 4.2% and AMD (AMD) shares fell 5%.

Forecasts from Nvidia

Despite the global shortage of semiconductors, Nvidia hopes to benefit from limited supply and strong demand for chips for data centre and cryptocurrency mining.

Nvidia's CFO said: "We expect demand to continue to exceed supply for most of this year. We believe we will have enough inventory to support consistent growth after the first quarter".

NVIDIA also raised its first-quarter revenue forecast for its new CMP product for industrial cryptocurrency mining from the previously expected $50 million to $150 million.