Takeover bid

Nvidia (NASDAQ:NVDA) has filed an application with Chinese antitrust authorities to review a $40 billion takeover of UK chip developer Arm, currently owned by Japanese tech giant SoftBank (T:9984).

The application has been filed in recent weeks and has triggered a review that Chinese antitrust lawyers say could take up to 18 months, the Financial Times reported on Tuesday, citing people familiar with the matter.

Last month, Nvidia said it planned to close the acquisition of Arm by March 2022. The original agreement with SoftBank was for September 2020.

Bloomberg reports that the Japanese conglomerate is in talks with banks for a loan of about $7.5 billion in connection with the deal, which is being coordinated by Mizuho Bank.

In February, Bloomberg reported that the US Federal Trade Commission had launched a thorough investigation into Nvidia's agreement to buy Arm, recalls Reuters.

At the same time, US chipmaker Qualcomm told regulators around the world that it opposed Nvidia's acquisition of UK chipmaker Arm.

The company told the Federal Trade Commission (FTC), the European Commission, the UK Competition and Markets Authority and China's State Administration for Market Regulation that it had concerns about buying Nvidia Arm, CNBC wrote.

The FTC has since asked SoftBank, Nvidia and Arm to provide it with further information. Sources said it could take many months to comply with the information request as several large documents would need to be prepared.

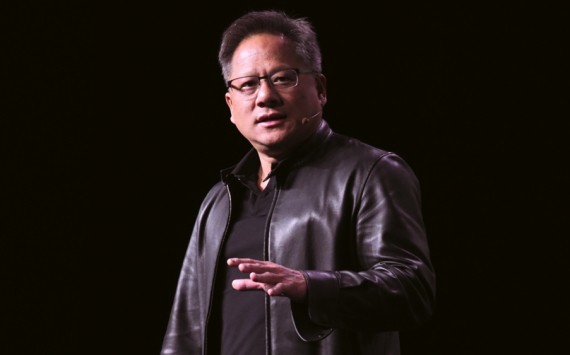

Meanwhile, Nvidia CEO Jensen Huang told the Financial Times last month that the US chipmaker had "started the process" of engaging with Chinese regulators and was confident that the deal would be completed within the time frame set by Nvidia.