Bank of America announced the issuance of a $2 billion Equality Progress Sustainability Bond designed to advance racial equality, economic opportunity and environmental sustainability, the first offering of its kind in the financial services industry.

The transaction also represents the first sustainability bond issued by a U.S. bank holding company where the social portion of the use of proceeds will be dedicated to financial empowerment of Black and Hispanic-Latino communities.

This is Bank of America’s eighth environmental, social and governance (ESG)-themed corporate bond, bringing the firm’s aggregate total of issuance to $9.85 billon.

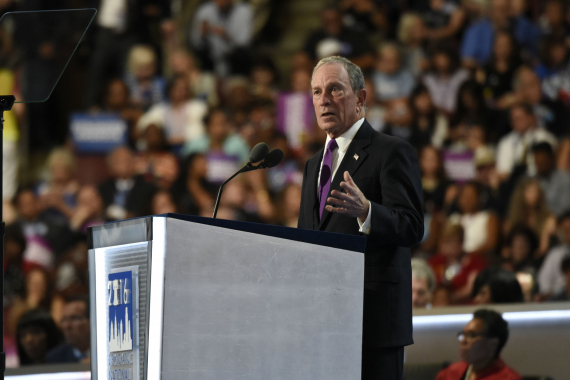

“Our focus on sustainable finance is one of the ways we drive responsible growth. By addressing these critically important issues through ESG-themed securities, we are offering a way for fixed income investors to be part of social and environmental change, and drive solutions through the debt capital markets,” said Anne Finucane, vice chairman at Bank of America, who leads the company’s ESG, sustainable finance, capital deployment and public policy efforts. “Our communities and the environment are inextricably linked, and Bank of America cares deeply about both and continues to explore innovative ways to enable investors to use their investments to help address these societal challenges.”

The five-year bond, which is callable in four-years, will pay interest semi-annually at a fixed rate of 0.981% for the first four-years, and quarterly at a floating rate thereafter. BofA Securities was the sole bookrunner on the deal and three minority-owned broker dealers served as joint lead managers - Loop Capital Markets, Ramirez & Co., Inc. and Siebert Williams Shank.

“Bank of America is proud to build upon its long-standing commitment to our communities through ESG and sustainable finance initiatives. This innovative offering aims to support progress toward racial equality and environmental sustainability by leveraging the company’s extensive capabilities and committed local engagement,” said Tom Montag, chief operating officer at Bank of America. “We believe this offering will inspire other issuers and mobilize additional capital to address these critical issues.”

Helping to accelerate social and societal equality and environmental sustainability

An amount equal to the net proceeds from the bond offering will be allocated to social and environmental purposes, helping to advance several of the United Nations (UN) Sustainable Development Goals (SDGs). The types of social projects benefiting from this offering – and any bond offering of other issuers with similar social purposes – have the potential to increase lending and investment in minority communities and businesses.

Financing and investment for social purposes that seek to help reduce inequalities for Black and Hispanic-Latino borrowers and communities in the U.S. including:

- Mortgage lending, construction loans and other financing and investments relating to single or multi-family housing or affordable housing projects;

- Financing for medical professionals to create or expand medical, veterinary and dental practices;

- Supply chain finance loans to be offered directly to minority-owned business enterprises;

- Deposits and equity investments in Black and Hispanic-Latino Minority Depository Institutions that are also Community Development Financial Institutions;

- Equity investments in Black and Hispanic-Latino owned or operated businesses and funds that invest in Black and Hispanic-Latino owned businesses.

Environmental projects include financing, leasing and investments that support the transition to a low-carbon economy, focusing specifically on renewable energy and clean transportation.

Within one year of the issuance of the notes, Bank of America will publish a report on a designated website, which will be updated at least annually as long as the notes remain outstanding, regarding the allocation to eligible social and green assets.

Leading the innovation and development in Sustainable Finance

Finucane and Montag co-chair Bank of America’s Sustainable Markets Committee, which collaborates across business lines to deliver innovative financing solutions in support of the U.N. SDGs.

Since 2013, Bank of America has issued $9.85 billion in corporate Green, Social and Sustainability Bonds - including five “Green” Bonds, two “Social” Bonds and today’s “Sustainability” Bond– which focused on areas such as clean energy, energy efficiency, affordable housing and community development, and addressing the global coronavirus pandemic. Additionally, Bank of America co-authored the Green Bond Principles, a voluntary set of guidelines and standards meant to bring integrity to this market where proceeds help to directly finance environmental projects. Bank of America has been a member of the executive committee of the industry group that provides guidance on ESG-Themed bond issuances since its inception.

BofA Securities’ dedicated ESG Capital Markets team has helped more than 150 clients support their sustainable business needs by raising over $200 billion in principal amount through more than 300 ESG-themed bond offerings.

Recent Bank of America announcements focused on racial equality, diversity and inclusion, and economic opportunity include:

Directs $300 million of its $1 billion, 4-year commitment to racial equality and economic opportunity.

Increasing representation of diverse asset managers across the industry.

Expanding support of Boys & Girls Clubs of America with $1 million grant to support educational programs.

Committing $100,000 to Athena Alliance to support underrepresented women.

Partnership with iHeartMedia to bring first-of-its-kind national audio news service to the Black community.

Smithsonian announces “Race, Community and Our Shared Future” initiative, BofA commits $25 million.

$1 Billion, four-year commitment to support economic opportunity initiatives.

Committing $250 million in capital and $10 million in philanthropic grants to CDFIs.