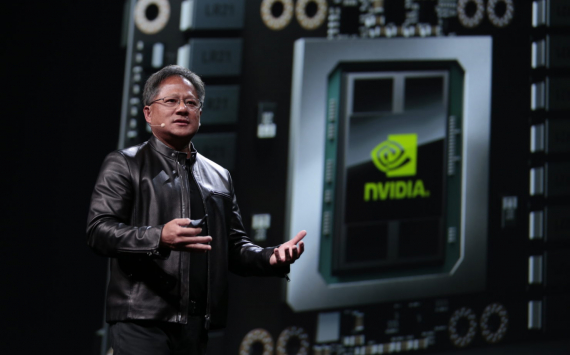

Lawsuit against Nvidia

The Federal Trade Commission (FTC) is suing the NVDA to block an agreement to merge ARM, the largest-ever corporate semiconductor merger. Analysts believe the authorities will block the merger, but they won't hurt Nvidia.

FTC sued to block Nvidia (NVDA) from investing Arm 40 billion to buy Arm, a British chipmaker owned by SoftBank Group.

Since many of Arm's customers are direct competitors of Nvidia the deal creates a conflict of interest, although Nvidia assures that it will maintain Arm's open licensing model and ensures that its intellectual property will be available to all interested licensees, current and future.

"Nobody expected the deal to happen," Bernstein Research analyst Stacy A. Rasgon said. "When this news came out, Nvidia's range increased. I want to see this deal, but I don't think I need it."

Nvidia (NVDA) shares, up 146% since the start of 2021, were up 2.2% on Thursday.

Wall Street really didn't seem to be counting on the completion of this deal, which first faced obstacles from UK and EU authorities, and also required US and Chinese approval.

The deal initiative between Nvidia and Arm also came at a difficult time for the semiconductor industry, with countries facing a global chip shortage that is hampering the production of cars and electronics, slowing the recovery of economies.

Competition issues in the industry, supply issues from China and difficulties in trade relations have also forced governments to pay more attention to the technology sector.

According to recent statements from Nvidia management, the company was aiming to close the deal with Arm by March 2022. Apparently, this will not happen as the Federal Trade Commission's administrative process is scheduled for 10 May 2022.

If the deal is not completed by September 2022, SoftBank will receive a break-up fee of $1.25bn.

Gartner analyst Alan Priestley, who specialises in the semiconductor industry, told CNBC that SoftBank would likely try to list Arm on the stock exchange if the deal with Nvidia falls through.

The London Stock Exchange and the Nasdaq stock market in New York are two potential listing venues.