While car buyers are increasingly using digital tools to shop for a car, data shows U.S. consumers say they still value the in-person experience at dealerships. That's according to Capital One's inaugural Car Buying Outlook, the first-ever survey of both consumer and dealer preferences, attitudes, and behaviors around auto financing. 77% of respondents reported they will research financing options and pre-qualification online more than before as a result of COVID-19. At the same time, in-person dealer experiences like test driving and negotiations are still important, with 82% of respondents saying they will visit more than one dealership.

“For most Americans, buying a car is one of the biggest purchases they’ll ever make, so it’s not surprising that they want to see, feel and experience this investment for themselves in person, alongside a trusted dealer advisor,” said Sanjiv Yajnik, President of Financial Services, Capital One. “The future of car buying requires embracing a model that marries digital tools with physical experience, empowering customers to have the car buying journey they want.”

Additional survey findings include:

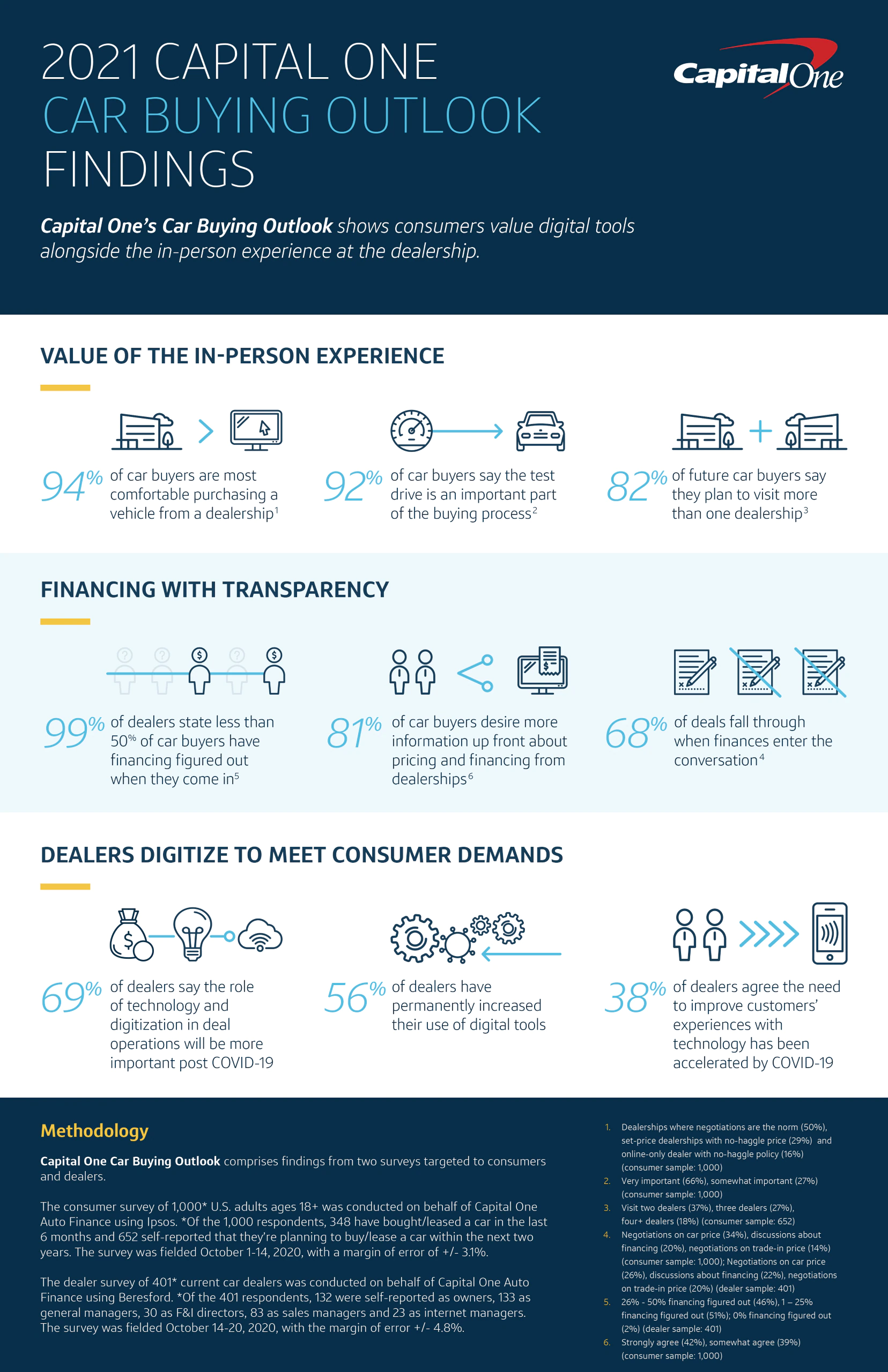

Value of the In-Person Experience

Consumers value in-person elements of the car buying experience and visited the dealership even in the midst of COVID-19.

- 94% of car buyers are most comfortable purchasing a vehicle from a dealership.1

- 92% of car buyers say the test drive is an important part of the buying process.2

- 82% of future car buyers say they plan to visit more than one dealership.3

- 43% of future car buyers plan to have financing discussions at the dealership.4

Financing with Transparency

Dealers play an important role in how car buyers understand their financing options.

- Two-thirds (68%) of deals fall through when finances enter the conversation, according to both dealers and car buyers.5

- 99% of dealers state less than half of their consumers have their financing figured out when they come in. 6

- 54% of car buyers state they think about financing after settling on a car, an increase from 43% in 2019.8

- 81% of car buyers say dealerships should provide more information up front about pricing and financing.9

Dealers Digitize to Meet Customer Demands

- Dealers are adopting digital tools to enhance customer engagement as more consumers turn online for shopping.

- 69% of dealers say the role of technology and digitization in dealer operations will be more important post-COVID-19.10

- 56% of dealers have permanently increased their use of digital tools to combat business challenges brought on by COVID-19.

- 38% of dealers agree that the need to improve customers’ experience with technology has been accelerated by COVID-19.

Metodology

Capital One’s Car Buying Outlook comprises findings from two surveys targeted to consumers and dealers.

The consumer survey of 1,000* U.S. adults ages 18+ was conducted on behalf of Capital One Auto Finance using Ipsos. *Of the 1,000, 348 have bought/leased a car in the last 6 months and 652 self-reported that they’re planning to buy/lease a car within the next two years. The survey was fielded October 1-14, 2020, with a margin of error of +/- 3.1%.

The dealer survey of 401* current car dealers was conducted on behalf of Capital One Auto Finance using Beresford. *Of the 401 respondents, 132 were self-reported as owners, 133 as general managers, 30 as F&I directors, 83 as sales managers and 23 as internet managers. The survey was fielded October 14-20, 2020, with the margin of error +/- 4.8%.

1Dealerships where negotiations are the norm (50%), set-price dealerships with no-haggle price (29%) and online-only dealer with no-haggle policy (16%)

2Very important (66%), somewhat important (27%) (consumer sample: 1,000)

3Visit two dealers (37%), three dealers (27%), four+ dealers (18%) (consumer sample: 652)

4Mostly in-person at dealership (32%), entirely in-person at dealership (12%) (consumer sample: 652)

5Negotiations on car price (34%), discussions about financing (20%), negotiations on trade-in price (14%) (consumer sample: 1,000); Negotiations on car price (26%), discussions about financing (22%), negotiations on trade-in price (20%) (dealer sample: 401)

626% - 50% financing figured out (46%), 1 – 25% financing figured out (51%), 0% financing figured out (%2) (dealer sample: 401)

7When I’ve decided on the car (in person) (36%), when I’ve found the car (online) (18%) (consumer sample: 1,000)

8When I’ve decided on the car (in person) (36%), when I’ve found the car (online) (18%) (consumer sample: 1,000)

9Strongly agree (42%), somewhat agree (39%) (consumer sample: 1,000)

10 Much more important (27%), somewhat more important (42%) (dealer sample: 401)