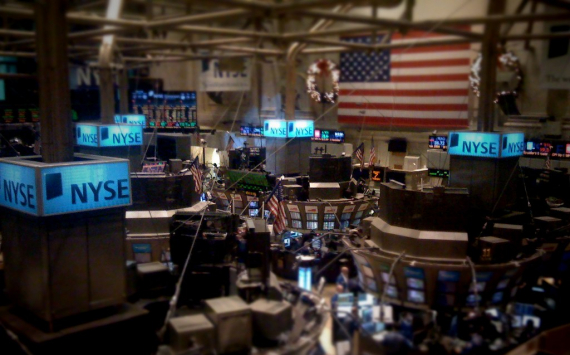

Stock futures rise

US stock index futures rose on Thursday after weaker-than-expected producer price data eased fears of a faster interest rate hike by the Federal Reserve while Delta Air Lines led gains among carriers on strong earnings.

The producer price index rose 0.2% last month, below the expected 0.4%, after rising 0.8% in November, the Labor Department said on Thursday. The PPI rose 9.7% in the 12 months to December, below the 9.8% forecast by economists polled by Reuters after rising 9.6% in November.

"They're high, and the numbers are certainly not good, but they were expected," said Joe Saluzzi, co-manager of Themis Trading in Chatham, New Jersey.

The figures further boosted stock index futures after Wall Street showed a slight increase on Wednesday, when consumer price data largely met market expectations, despite hitting a 40-year high.

Delta Air Lines added 2.4% in pre-market trading after beating fourth-quarter profit estimates and said it had recovered almost 80% of its earnings before the 2019 pandemic.

Shares of American Airlines and United Airlines rose 1.5% each.

According to Vanda Research's weekly retail flows report, banks have been among the best performers since the start of the new year, with retail investors also increasing their investment in bank stocks ahead of earnings announcements.

Also in the spotlight is Fed chief Lael Brainard, who will appear at a congressional hearing later in the day for her nomination as vice-chairman.

The Dow e- mini 1YMcv1 rose 111 points (0.31%), the S&P 500 e-minis EScv1 rose 11.25 points (0.24%) and the Nasdaq 100 e- mini NQcv1 rose 58.75 points (0.37%).

However, Wells Fargo follows Goldman Sachs, JPMorgan and Deutsche Bank in forecasting aggressive tightening of US monetary policy in the coming months and predicts that the Fed will raise interest rates four times this year.

US technology companies Nvidia, Analog Devices, Texas Instruments as well as Advanced Micro Devices (AMD) rose 1 per cent after Taiwan-based chip giant TSMC said it expects strong growth in coming years due to the semiconductor boom. demand.