Description

Analog Devices is an American multinational semiconductor company specializing in data conversion, signal processing and power management technology, headquartered in Wilmington, Massachusetts.

The company manufactures analog, mixed-signal and digital signal processing (DSP) integrated circuits (ICs) used in electronic equipment. These technologies are used to convert, condition and process real-world phenomena, such as light, sound, temperature, motion, and pressure into electrical signals.

Analog Devices has approximately 100,000 customers in the following industries: communications, computer, instrumentation, military/aerospace, automotive, and consumer electronics applications.

History

The company was founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965. The same year, the company released its first product, the model 101 op amp, which was a hockey-puck sized module used in test and measurement equipment. In 1967, the company published the first issue of its technical magazine, Analog Dialogue.

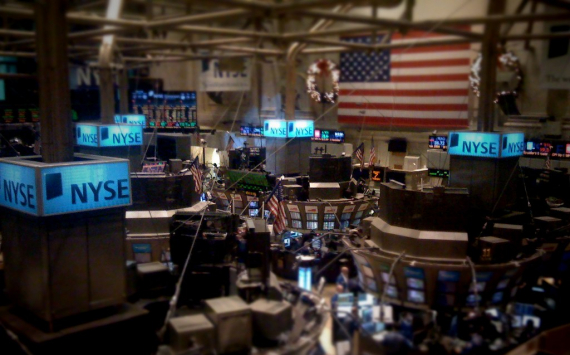

In 1969, Analog Devices filed an initial public offering and became a publicly traded company. Ten years later, the company was listed on the New York Stock Exchange.

In 1973, the company was the first to launch laser trim wafers and the first CMOS digital-to-analog converter. By 1996, the company reported over $1 billion in company revenue. That same year, Jerald Fishman was named president and CEO, a position he held until his death in 2013 (see below).

In 2000, Analog Devices's sales grew by over 75% to $2.578 Billion and the company acquired five companies including BCO Technologies PLC, a manufacturer of thick film semiconductors, for $150 million.

In January 2008, ON Semiconductor completed the acquisition of the CPU Voltage and PC Thermal Monitoring Business from Analog Devices., for $184 million.

By 2004, Analog Devices had a customer base of 60,000 and its portfolio included over 10,000 products.

In 2012, the company led the worldwide data converter market with a 48.5% share, according to analyst firm Databeans.

In July 2016, Analog and Linear Technology agreed that Analog would acquire Linear in an approximately $14.8 billion cash and stock deal.

In July 2020, Analog agreed to acquire Maxim Integrated in an all stock deal that values the combined company at $68 billion.