Trump's Truth Social flop

Former President Donald J. Trump recently released a personal financial disclosure to the FEC, providing the public with insight into his post-presidential business dealings.

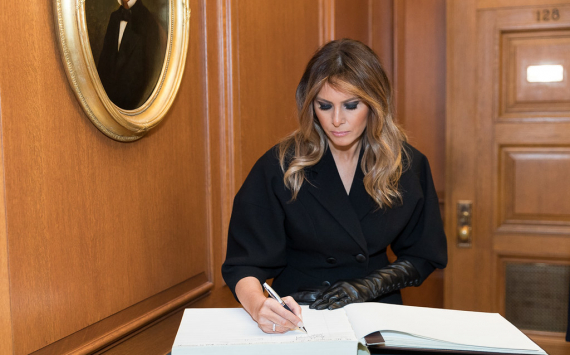

While the documents filed with the Federal Election Commission do not offer many specifics, they do reveal a few noteworthy developments, including lower-than-expected values for his social media company, two significant bank loans, and a new income stream for his wife, Melania Trump.

Trump had requested multiple extensions to file his disclosure and was warned that he would face fines if he failed to submit it within 30 days of a March 16 deadline. The disclosure shows cumulative income from January 2021 to December 15, 2022, as required by the Federal Election Commission, and the value of assets as of December 2022.

The value of Trump's Truth Social platform is between $5-25 million, significantly lower than the expected $9 billion. The current estimate only reflects the value of Trump's holding and the intrinsic value is much less than anticipated.

Federal investigations have delayed the merger of Digital World, causing their stock to drop from $97 to $13.10. If the deal goes through, Trump Media could receive $300 million and increase Mr. Trump's wealth. Trump could potentially receive 70 million shares, and the deadline for the merger is in early September. The Securities and Exchange Commission is still investigating the proposed merger.

The financial disclosure also revealed that Mr. Trump owns 90% of Trump Media, and the company's CEO is Devin Nunes, a former Republican congressman from California. The report does not identify the owners of the other 10% of the company.

The report reveals that Trump settled six loans, including those over $50 million on Trump Tower in NYC and Trump Doral in Miami. Axos Bank granted him new loans, also exceeding $50 million, on these properties. Trump Doral remains the top revenue-generating asset of his family business.