The Chinese billionaire Jack Ma, who has fallen out of favor with the Chinese authorities, is trying to save the first public sale of shares in Ant Group.

Ant Group is a subsidiary of Alibaba Group, with a 33% shareholding, and the largest fin-tech company in the mobile payment market in China, with Alipay payment system coverage of almost 55% of the market. Going public automatically means an increase in the company's transparency, which will help attract new partners and customers especially since Ant Group has been trying to position itself not as a payment system, but as a technology company in recent years.

Ant Group's 2019 net profit is 2.4 billion.The public offering of Ant Group would not only attract new investors in the subsidiary, but also increase the value of the shares of the parent company.

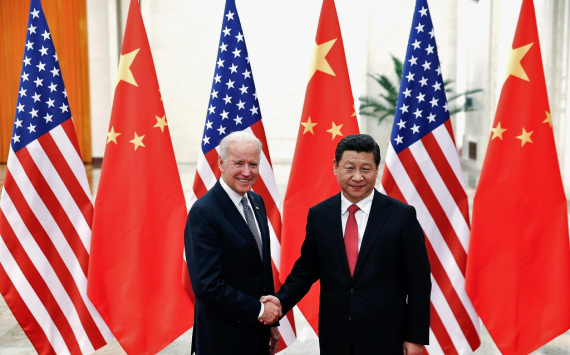

In negotiations with the central bank of China, Chinese insurance companies and government agencies that regulate the securities market, Jack Ma proposed "nationalizing some of Ant Group's platforms if they are necessary for the country's well-being." Unfortunately, this gesture of peacefulness was not appreciated by the President of the People's Republic of China Xi Jinping, who categorically forbade the deployment.

Ant Group has come under a campaign by the Chinese authorities to contain the largest tech companies in China and antitrust the market. One of the methods of regulation of which is tough interference in the regulation of the company's capital and tightening of its management levers.

At the current moment, there is no information whether the Chinese authorities will accept Jack Ma's proposal in the future and agree to part of the company, or state banks and state investors will decide to fully buy out the company.