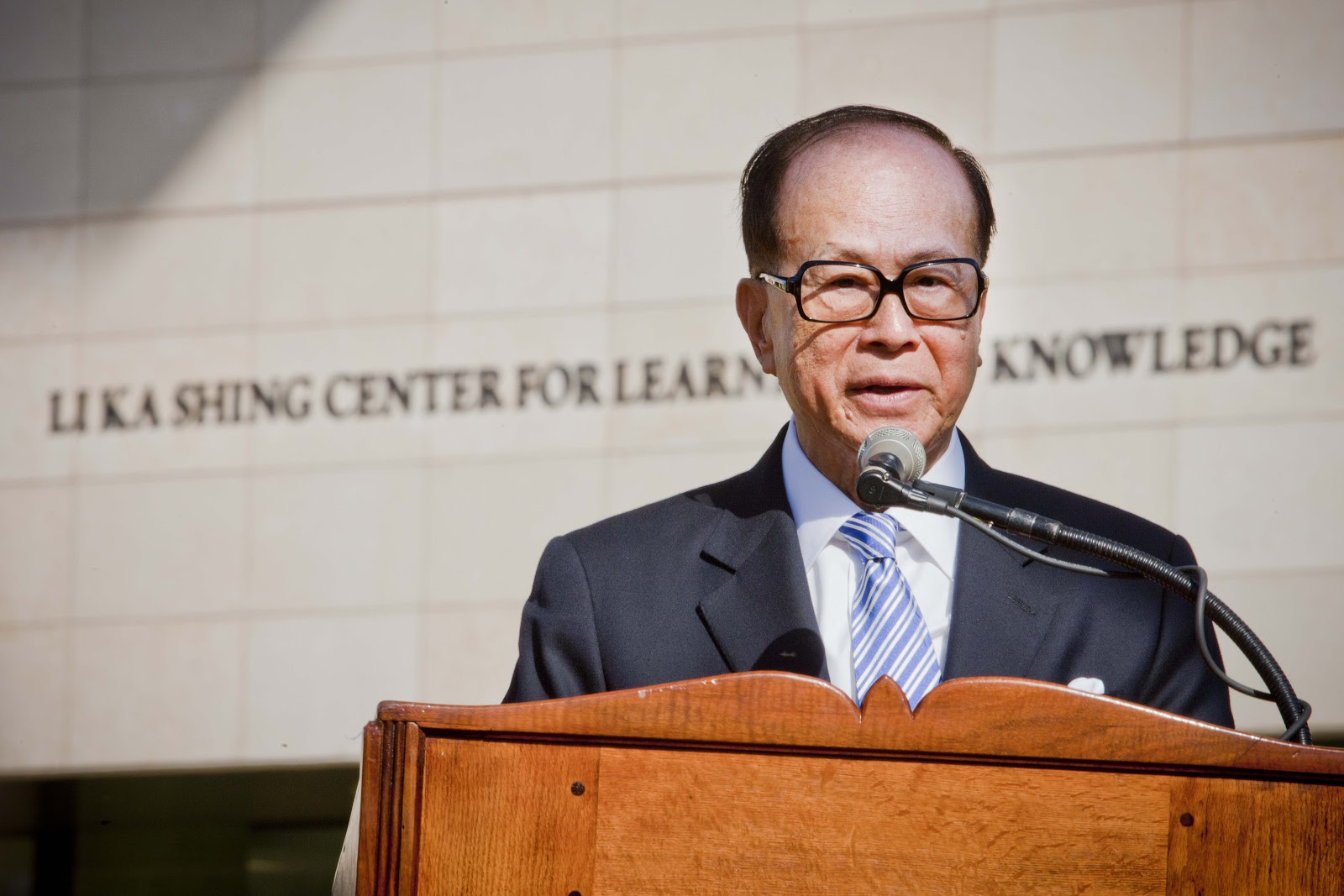

LI

Ka-shing

Businessman

Fortune($mln)~: 32700

Date of Birth: 13 June 1928

person_view.holiday: Community Association Managers Day

Age: 96 years old

Zodiac sign: Gemini

Profession: Businessman

Biography

Li Ka-shing (cant.trad. 李嘉誠, ex. 李嘉诚, yutphin: Li3 Jia1cheng2, yel: Li Ka-shing, cant.-rus .: Li Khaxing, pinyin: Lǐ Jiāchéng, pall .: Li Jiacheng; genus 13 June 1928) is a Hong Kong entrepreneur and philanthropist, one of the most influential businessmen in Asia (nicknamed "Superman" in business circles). As of 2012, he was the richest man in Hong Kong and Asia, and also ranked ninth among the richest people in the world (according to Forbes magazine, Li Ka-shing's capital was $ 25.5 billion). In 2013, with a fortune of $ 30.2 billion, he retained the title of the richest man in Asia. He is currently the chairman of the board of Cheung Kong Group and Hutchison Whampoa, whose capitalization is about 15% of the Hong Kong stock market (in addition, Li Ka-shing's structures have built every seventh apartment in Hong Kong, they control 70% of the cargo turnover of the Hong Kong port, have significant shares in the retail, mobile and electricity markets). Li Ka-shing's companies employ over 270,000 people in 53 countries around the world.

Li Ka-shing was born on June 13 (according to other sources - July 29), 1928 in Chao'an County, China's Guangdong Province, into a poor family of a school teacher, at the age of 10 he miraculously recovered from tuberculosis. In 1940, fleeing the Japanese invasion and the hardships of the war, the Li family fled to Hong Kong, where they were sheltered by a wealthy relative. In 1942 (according to other sources - in 1943), Lee's father, unable to pay for treatment, died of tuberculosis, and the teenager, who did not even graduate from five classes, had to sell watch straps, and soon got a job in a factory for the production of plastic flowers ... Lee worked 16 hours a day in hazardous industries - stamping and painting artificial roses, and after his shift attended night school.

Start of entrepreneurial activity

Without a specialized education, Li Ka-shing began his career as an entrepreneur in retail (having accumulated scanty start-up capital, he left the factory and began to sell artificial flowers), and in 1950, having $ 8.7 thousand (the cost of a good car ), has already taken charge of the plastic products company Cheung Kong or Changjiang. The business began to grow rapidly when Cheung Kong began exporting artificial flowers to the United States, and also launched the production of plastic toys, soap dishes and combs (Lee drew model designs from overseas catalogs). With the income received, Li Ka-shing began to acquire real estate in the colony, which fell sharply in 1967 due to the outflow of British capital, frightened by the "cultural revolution" and unrest in Hong Kong. In order not to overpay for the land, Li offered the land owners a share in the objects that he was going to build on this site (and these were mainly cheap housing for refugees from mainland China and various office premises). By the end of the 1970s, Lee, who had sold the plastics industry by that time, had become the largest private developer in the colony (in 1972-1978 alone, Cheung Kong increased its capital from 84 million to 700 million races).

One of the components of Li Ka-shing's success were his personal qualities: hard work, diligence and decency. Lee said, "If you maintain a good reputation, work hard, be a good person and keep your promises, your business will grow much easier" and "Your and your company's good reputation is an invaluable asset that is not reflected in the balance sheets." ... Another famous quote from him was "The greatest pleasure for me is to work hard and make more profit."

Building a business empire

In 1979, Li Ka-shing became the first Chinese businessman to buy (from The Hongkong and Shanghai Banking Corporation) a large British company in Hong Kong - Hutchison Whampoa or "Heji Huangpu" invested in trade, real estate, warehousing, port infrastructure, soft drinks production, subsoil development and the financial sector). Under his leadership, the reorganized company has grown into the world's largest private port operator and a major trading, construction, telecommunications and energy multinational corporation. In the 1980s, Li Ka-shing focused on stock trading and began investing in new areas of the economy. A feature of Li Ka-shing's tactics was that he predicted those areas of business that would become profitable in the future, and invested money in them, and when the value of the acquired company reached its maximum, he sold it. Lee also became famous for his dedication to advanced technology. In this regard, he said: "A person who invests in technology feels younger."

In 1985, Li Ka-shing became a shareholder in the power company Hongkong Electric, and his other company, Hutchison Telecom, became the world's first AMPS and TACS analog mobile operator. In 1987, Li Ka-shing first appeared in the Forbes magazine's billionaires rating and became a co-owner of the large Canadian oil and gas corporation Husky Oil (in 1991, he consolidated its controlling stake in himself).

Having entered the UK mobile communications market, Li Ka-shing acquired the unprofitable Rabbit service in 1991, promoted it under the Orange brand, and in 1999 sold it to the German concern Mannesmann AG for $ 14.6 billion. The Hutchison Group soon returned to the UK telecom market and purchased a wireless Internet license.

In 1992, Li Ka-shing met with Deng Xiaoping, who was touring southern China, underscoring the important role the businessman played in Hong Kong-China relations. In 1995, Li joined the committee preparing the transfer of Hong Kong to Chinese sovereignty. In 1996, Lee Ka-shing's Hutchison Port Holdings took control of the ports of Cristobal and Balboa on both ends of the Panama Canal.

In 1998, the total sales in retail chains controlled by Li Ka-shing amounted to $ 2.7 billion, and the turnover of his container ports was 14.1 million TEU. In 2000, the market capitalization of Li Ka-shing's companies exceeded $ 100 billion, accounting for 10% of the total market capitalization of all Hong Kong companies.

Activities in the XXI century

In 2000, Li Ka-shing had an unsuccessful public offering of his company, TOM Group, but his investments in the high-tech sector were quite successful in the future. In 2005, he invested in Skype, in 2007 - in the social network Facebook, in 2009 - in Siri (in 2010 it was taken over by Apple), then in the music service Spotify, navigation service Waze, video editor Magisto and waterproofing equipment HzO. Lee was not even afraid to invest $ 300,000 in the ideas of 15-year-old programmer Nick D'Aloisio.

Li Ka-shing did not leave without his attention the traditional sectors of the economy, including in Europe, which was going through a financial crisis. In 2010, Lee's structures for more than $ 9 billion purchased from the French company Électricité de France its British electric power assets, in 2011 they bought the British Northumbrian Water Group (water supply and sewerage), in 2012 - the Austrian mobile operator Orange Austria. Also in 2012, Li Ka-shing made a major investment in Australia - he bought the agricultural trading company Peaty Trading Group, three vineyards and the largest salt producer Cheetham Salt.

But Li Ka-shing not only actively bought, but also successfully sold assets. In 2006, he sold a 20% stake in Hutchison Port Holdings to PSA International (Port of Singapore Authority), and in 2007, his stake in the Indian mobile operator Hutchison Essar to the British Vodafone group for more than $ 11 billion.

Lately, Lee has been increasingly focused on strategic planning, trying to move away from the current affairs of the group (as he himself said in an interview: "I spend more time planning tomorrow than solving today's goals"). In 2012, in the elections for the head of Hong Kong, Li Ka-shing supported the pro-Beijing candidate Henry Tan.

Asset structure

Real estate - real estate operator Hutchison Whampoa Property (residential complexes Whampoa Garden, Laguna City, South Horizons, Rambler Crest and Caribbean Coast, office complex Cheung Kong Center), hotel operator Harbor Plaza Hotel Management (Harbor Plaza hotel chain).

Retail trade - Watson’s perfume and cosmetics chain, Park-n-Shop, Gourmet, Taste and Great supermarket chains, Watson`s Wine Cellar chain of wine and cigar stores, Fortress chain of consumer electronics stores.

Logistics - port operator Hutchison Port Holdings, Hong Kong Air Cargo Terminals.

Telecommunications - mobile operator and ISP Hutchison Telecommunications International, ISPs Hutchison Global Communications and TOM Online.

Energy and oil and gas industry - energy companies Power Assets Holdings, Hongkong Electric, Power Assets Investments and Associated Technical Services, Canadian oil and gas company Husky Energy, operator of projects in energy, transport infrastructure and water supply Cheung Kong Infrastructure Holdings.

Food industry - drinking water producer Watson`s Water, juice producer Mr. Juicy.

Mechanical Engineering & Electronics - Hong Kong United Dockyard shipbuilding company, toy, souvenir, telecommunication accessories and electronics manufacturer Hutchison Harbor Ring, UK mobile phone manufacturer INQ.

Building materials production - Green Island Cement cement company.

Biotechnology is a biotechnology company CK Life Sciences International.

Mass media - TOM Group media holding, China Entertainment Television, Metro Broadcast Corporation.

Advertising - outdoor advertising operator TOM Outdoor Media Group.

Financial services - Ming An Holdings insurance company, Horizons Ventures investment company.

Li Ka-shing takes over risky investments through Horizons Ventures, as well as other possible losses, and transfers all guaranteed profitable investments to his Li Ka Shing Foundation /

Charity

Having survived poverty and disease in childhood, without receiving an education, Li Ka-shing, having become rich, became a major philanthropist. In an interview, he said the phrase that has become famous: “The future is made up of many components, but it is born in the hearts and minds of people. Therefore, you need to think not only about achieving your own goals, but also about the fate of all mankind. "

In 1980, Li Ka-shing launched a charitable foundation in his name (Li Ka Shing Foundation), which donated millions of dollars to universities and hospitals in East Asia and North America. For example, already in 1981, he allocated 3 million dollars for the construction of Shantou University, then large donations followed to the library of the Singapore University of Management (later named after the patron), Singapore National University, Hong Kong University (the medical faculty of the university was named after Li Ka-shing). The University of California at Berkeley and the University of Alberta. Li Ka-shing also supported the victims of the Indian Ocean tsunami (2004), the floods in his native Chaozhou (2006) and the Sichuan earthquake (2008), purchasing medicines and basic necessities, financing the restoration of housing and communications. In 2009, Li donated $ 15 million to build a Chinese pavilion for the World Expo 2010 in Shanghai. In total, through his fund, which has a total asset value of $ 8.3 billion, Lee has provided more than $ 1.6 billion in grants to support education, health and culture (about half of the funds went to funding medical institutions and research in the field of health , about 2/5 - to finance educational institutions and educational programs).

Performance evaluation

For the first time, Li Ka-shing's possible ties with official Beijing were spoken about in 1979, when he bought a large corporation Hutchison Whampoa (such a large-scale deal could not go through without the approval of the authorities of Great Britain and China, especially in the midst of negotiations on the further fate of the British colony) [21 ].

Li's connections with high-ranking officials in China and Hong Kong (at one time he was on the board of directors of the state corporation CITIC), who lobbied for the interests of his business, as well as attempts to influence the political climate of Hong Kong to please Beijing, often drew sharp criticism from the public. In the United States, some members of Congress expressed concern that, thanks to his ties with the top leadership of the PRC, Li Ka-shing became the owner of ports on both ends of the Panama Canal, and this, in turn, posed a threat to the national security of the United States. [7] [9] [16] ...

Also, US law enforcement agencies suspected Li Ka-shing of transferring Western secret technologies to China through his companies and links with the Hong Kong triads, in particular, through businessmen with dubious reputations Henry Fock and Robert Kuok (the first was involved in smuggling goods and weapons, the second - drug trafficking).

Some professors and alumni of the Faculty of Medicine at the University of Hong Kong opposed the fact that the faculty was named after Li Ka-shing, who worked closely with the Chinese communist regime.

Li Ka-shing is an Honorary Doctor of Jurisprudence from the University of Cambridge and an Honorary Doctor of Peking University. In 2001, Li Ka-shing was named "Asia's Most Influential Man" by Asiaweek magazine. In 2006, Time magazine included him in the honorary list of "Heroes of Asia for the last 60 years." There is a saying in Hong Kong that from every dollar spent in the city, 5 cents goes into Li Ka-shingu's pocket.

Personal life

Li Ka-shing, despite his personal condition, is very modest in everyday life, he still wears cheap shoes and a plastic watch. In his youth he was fond of photography, among his hobbies today are golf, gardening, feng shui, reading books on philosophy, history, economics and politics, collecting figurines of the mythical animal "Pi Yao" (Li Ka-shing said: "I know how to find peace in my heart and in my soul. If I have a short vacation, I will devote it to reading "). Lee lives in a two-story mansion in Hong Kong's Repul's Bay, which he shares with his eldest son's family, and works from his office located in the Cheung Kong Center skyscraper.

Li Ka-shing's wax figure

Li Ka-shing's wife Lei Chong Yutming (Li Chuang Yueming), with whom he lived for 27 years, died of a heart attack in 1990 at the age of 56, and Li never married again. Li Ka-shing has two sons - the elder Victor Lee (born 1964), who holds the posts of vice chairman of Cheung Kong (Holdings) and Hutchison Whampoa, and the younger Richard Lee (born 1966), who has a stake in family business, but runs his own corporation, Pacific Century Group. Interestingly, Li calls the charity Li Ka Shing Foundation his third "son". Li Ka-shing also has seven grandchildren: three daughters and a son are growing up in Victor's family and three sons in Richard's family.

In 1996, Li Ka-shing's son, Victor, was kidnapped for ransom. Lee immediately paid 1 million races. dollars and his son were released, and soon the police of mainland China detained the criminal, whom the court sentenced to death (according to the widespread version, Li did not contact the Hong Kong police, but directly appealed to the top leadership of China). In January 2006, gangsters from mainland China tried to steal the remains of Li's wife from a grave in a Buddhist cemetery on the east coast of Hong Kong Island in order to demand a ransom for them, but their plan failed.

Popular culture references

The Miracle: The Epic Story of Asia’s Quest for Wealth (2009) by Michael Schumann.

The wax figure of Li Ka-shing is installed in the Hong Kong Museum of Madame Tussauds.

May 6, 2021 Bloomberg estimated his fortune at $ 32,700 million

Born in one day

person_view.holiday: Community Association Managers Day

(Dragon) .

Horoscope Gemini: horoscope for today, horoscope for tomorrow, horoscope for week, horoscope for month, horoscope for year.