Inside the Billionaire Exodus

As the market scales dizzying heights, a wave of high-profile figures is seizing the opportunity to offload hefty chunks of their company shares. From tech titans to financial moguls, the sell-off frenzy is hitting headlines, raising eyebrows, and prompting questions about the motives driving these colossal transactions.

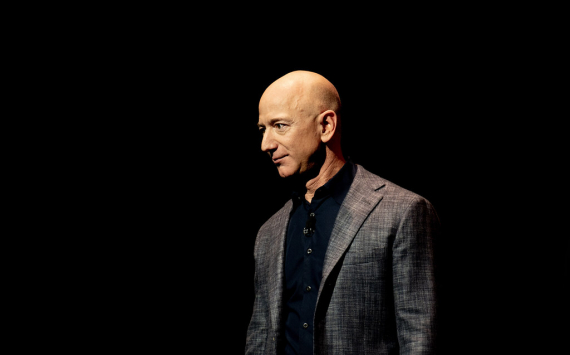

The Big Players in the Game

Jeff Bezos sold $8.5 billion in Amazon shares, Jamie Dimon divested $150 million in JPMorgan Chase stocks after 18 years, and Leon Black made his first stock sale, earning $172.8 million from Apollo Global Management.

Zuckerberg's Metamorphosis and the Walmart Dynasty's Strategy

Mark Zuckerberg, the enigmatic force behind Meta, formerly Facebook, orchestrated a spectacle of stock sell-offs, shedding 1.4 million shares valued at approximately $638 million. This latest liquidation follows a strategic pattern, with Zuckerberg offloading sizable chunks of Meta shares over recent months, amassing proceeds totaling a staggering $1.2 billion. Meanwhile, the Walton family, guardians of Walmart's legacy, orchestrated a $1.5 billion stock sale, a calculated move in their portfolio management playbook.

Behind the Scenes: Trading Plans and Strategic Maneuvers

Many of these transactions are executed via meticulously crafted 10b5-1 trading plans, prearranged mechanisms designed to execute sales at predetermined intervals or price thresholds. Crafted to navigate regulatory waters and sidestep allegations of insider trading, these plans offer a shield against legal scrutiny while providing a systematic approach to portfolio diversification.

Navigating Uncertain Horizons

Stock indices surge as analysts attribute it to potential political uncertainties and tax policy changes. Seasoned compensation consultant Alan Johnson suggests investors are securing positions amidst looming political upheaval, hedging their bets in a buoyant market.

Dimon's Departure: Speculations and Legacy

Jamie Dimon's shift away from holding company stock has raised questions about his future at JPMorgan Chase. With a net worth of $2.1 billion, his move sparks speculation about long-term plans and potential successors. This departure from convention adds intrigue to the financial landscape.